Introduction

As an investor navigating the world of finance and investing, I understand the immense significance of the concept of “adjusted close.” It plays a vital role in making informed decisions based on accurate historical data. You probably see the “Adjusted Close” option on Yahoo, Etoro, Robinhood charts. In this article, I will delve into the intricacies of adjusted close, explore its importance, and gain insights into when and how to effectively utilize this metric. I will make it my mission to provide you with the most clear and understandable explanation of adjusted close.

Adjusted Close and Close Explained

1. Close: The Traditional Stock Price

The term “Close” refers to the closing price of a stock or any other financial asset for a particular trading day. It represents the final price at which a security is traded before the market closes for the day. The Close is widely used by investors, traders, and analysts to evaluate the performance of a stock or to calculate various technical indicators. It is a fundamental data point in financial markets and provides valuable insights into the price movement of a security.

2. Adjusted Close: Accounting for Corporate Actions

While the Close provides a snapshot of a stock’s price at the end of the trading day, the Adjusted Close takes into account certain corporate actions that can affect the stock’s price. These corporate actions may include stock splits, dividends, rights offerings, or any other event that impacts the stock’s value.

The Adjusted Close adjusts the stock price to reflect the impact of these actions, allowing for a more accurate representation of the stock’s true performance.

3. The Difference: Adjusted Close vs. Close

The main difference between Adjusted Close and Close lies in their treatment of corporate actions. The Close represents the actual trading price of a stock at the end of the day, while the Adjusted Close adjusts the Close to account for any corporate actions that may have occurred. By factoring in these adjustments, the Adjusted Close provides a more accurate picture of a stock’s historical performance, making it a valuable tool for investors and analysts.

Why use Adjusted Close?

There are several instances when using adjusted close becomes advantageous. One such scenario is when conducting historical analysis, as it allows for a more precise assessment of a stock’s growth and performance over time. I’m going to show you two situations where adjusted close is essential.

1. Adjusted Close and Dividends with an example

Dividends are an essential component of investing, and the adjusted close takes them into account. When a stock pays dividends, the price of the stock typically decreases by the dividend amount. By adjusting the close to account for dividends, the adjusted close provides a more accurate picture of the stock’s price appreciation.

Let’s consider the example of Company XYZ to demonstrate the calculation of adjusted close with dividends.

Suppose you are analyzing the stock price of Company XYZ over a certain period. Here is the historical data:

- Day 1: Closing Price = $100

- Day 2: Closing Price = $105

- Day 3: Closing Price = $110

- Dividend

- Day 4: Closing Price = $105

On Day 3, Company XYZ announced a dividend of $5 per share to be paid to its shareholders. To calculate the adjusted close, you need to adjust the stock price for this dividend.

First you have to calculate the adjustment factor: $105/$110= 0.955

The historic close prices prior to the ex-dividend date are then multiplied by the adjustment factor so that they stay rationally aligned:

- Day 1: Closing Price = $95,5

- Day 2: Closing Price = $100,28

- Day 3: Closing Price = $105

- Day 4: Closing Price = $105

By incorporating the dividend into the adjusted close calculation, you get a more accurate representation of the stock’s true performance, eliminating the distortion caused by the dividend payment.

It’s important to note that this is a simplified example, and in reality, there may be other factors and adjustments involved in calculating the adjusted close, such as stock splits or other corporate actions. The calculation may vary depending on the specific circumstances and data available for the company you are analyzing.

Marketadvisor.io adjusts its data for both splits and dividends, and we use the Chicago Booth algorithm to do that as the most proven algorithm in the industry.

2. Adjusted Close and Stock Split with an example

Stock splits can have a significant impact on a stock’s price and overall value. In a stock split, the number of shares outstanding increases, while the price per share decreases. Adjusted close adjusts for this change, ensuring that the historical performance of the stock remains consistent and comparable.

And that’s the most important thing: keeping the share price comparable over time. I’ll make things clearer with an example.

Let’s continue with our example of Company XYZ.

Suppose Company XYZ undergoes a 2-for-1 stock split. This means that for every one share of Company XYZ held by shareholders, they will receive two shares. Let’s consider the following historical data:

- Day 1: Closing Price = $100

- Day 2: Closing Price = $105

- Day 3: Closing Price = $110

- Stock Split

- Day 4: Closing Price = $55

As you can see, the share price has been halved on Day 4, but the share has not actually fallen by 50%. Why not? Because you received 2 shares for every share you held. So in the end, the total value of the shares held remained the same.

This is why the adjusted close is interesting in this case. To calculate the adjusted close on day 4, you need to multiply by 1/(stock split ratio), so in this example I’m multiplying by 0.5.

The adjusted Close will be then:

- Day 1: Closing Price = $50

- Day 2: Closing Price = $52,5

- Day 3: Closing Price = $55

- Day 4: Closing Price = $55

Once again, in reality the calculation formula is more complex. As said before, we use the Chicago Booth algorithm.

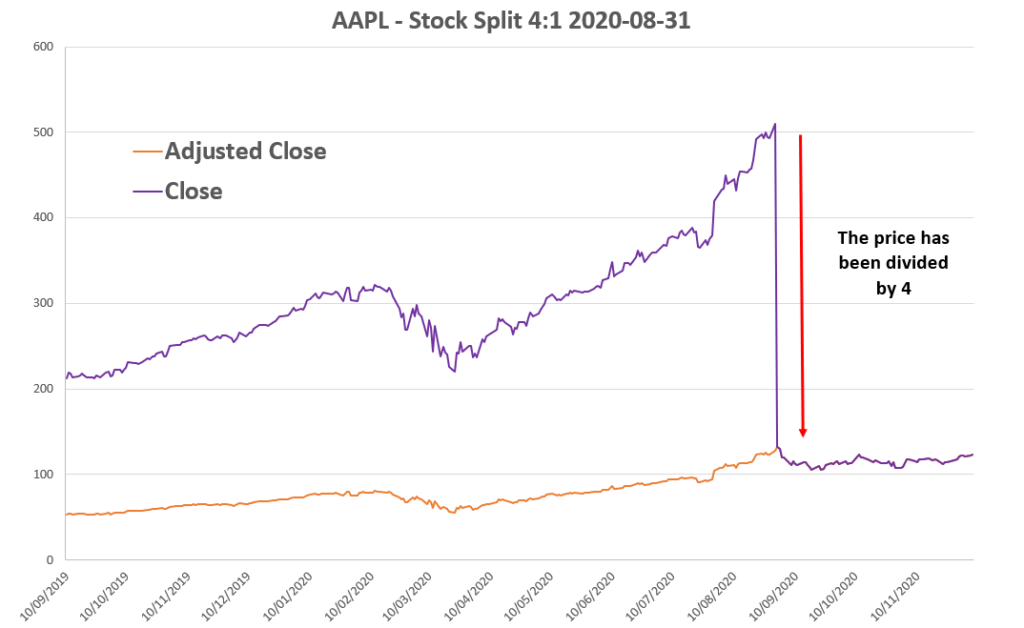

Here’s an example of an Apple stock split. You can see the difference between the close and the adjusted close:

Conclusion

Understanding the significance of adjusted close is crucial in making informed investment decisions. The stability it provides in price movements, the elimination of distortions caused by dividends and stock split, and its facilitation of comparative analysis are all invaluable in assessing a stock’s true performance.

I hope you’ve understood the difference between closing and adjusted closing.

Remember: always use the adjusted close if you want to compare two historical stock data.

Frequently Asked Question about Adjusted Close :

Does Yahoo, eToro, Robinhood or differents brookers has the same Adjusted Close :

Yes, the adjusted close is based on the historical events of a company (splits and dividends). So the information should be exactly the same on all platforms. If there is a difference, it could come from the spread.

Why there is no Adjusted Open ?

Theoretically, you could create an adjusted open, but there is no reason to do so. Since the adjusted close is useful for historical analysis, we always look at the end of the day information.