Introduction

Greetings and salutations! Welcome to our all-encompassing manual that demystifies the art of investing in stocks! Delving into the stock market can wield formidable potential to amplify your wealth and realize your financial aspirations. Nevertheless, it might prove to be a labyrinth of bewilderment, especially for novices. Fear not, for within these pages, we shall furnish you with lucid and actionable steps, paving your way to embark upon the mesmerizing journey of the stock market and triumph over it.

Deciphering the Bedrock of the Stock Market

The Nature of Stocks

Behold, for stocks embody a claim of proprietorship in a company. Once you acquire shares in a company’s stock, you metamorphose into a partial owner of that very enterprise. As the company’s value burgeons, so does the worth of your shares. Conversely, if the company stumbles, the value of your shares might wane.

The Significance of Inquiry

Before you commence your investment endeavors, diligently embark on extensive research. Seek out companies adorned with robust fundamentals, a steadfast business model, and a historical trajectory of unwavering growth. Delving into financial statements, comprehending the company’s competitive edge, and investigating industry trends stand as indispensable constituents of the research process.

Start Your Expedition into the Stock Market

Defining Precise Investment Objectives.

Concretely articulate your investment goals. Do you seek long-term growth, or do immediate returns tantalize you? The comprehension of your objectives shall lay the groundwork for discerning your risk tolerance and devising an investment strategy.

Assessing Your Risk Tolerance.

Stock market investments bear a measure of peril. It is imperative to gauge your risk tolerance to weather the tempestuous fluctuations of the market. Should you embrace caution, perhaps stable, blue-chip stocks beckon; yet, if you find solace in risk, you might set forth on an exploration of high-growth potential stocks.

Diversification: Distributing Your Bets

In order to mitigate risk, the strategic ploy of diversification comes into play. Eschew investing your entire funds in a singular stock or sector. Rather, disseminate your investments across diverse industries and asset classes. Thus, should one investment falter, others may bear the mantle and restore balance.

Selecting the Optimal Brokerage Account

The art of smooth stock market transactions lies in selecting the fitting brokerage account. Seek out a brokerage that offers frugal fees, an intuitively navigable platform, research tools aplenty, and top-notch customer support.

For instance you can start with etoro. This is a well-designed site that lets you invest quickly without having to think about it. Be careful, however, not to be tempted by the site’s apparent ease of use. (By the way, if you click on the link, we have no partnership with them, nor are we remunerated by them).

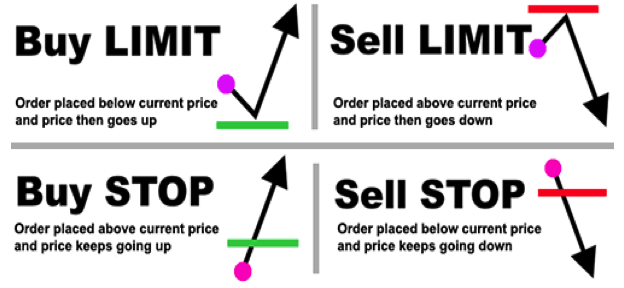

Decoding Stock Market Order Types

A fundamental grasp of various order types proves critical in your stock market exploits. Among these are market orders, limit orders, and stop-loss orders. Each fulfills a specific purpose, empowering you to execute trades with finesse.

Fundamental Analysis versus Technical Analysis

The Veil of Fundamental Analysis

Behold the mystique of fundamental analysis, an art that entails the evaluation of a company’s financial health and prospects. This meticulous examination draws upon financial statements, earnings reports, and the quality of management to unveil a company’s intrinsic value.

Unveiling the Secrets of Technical Analysis

In contrast, technical analysis unfurls the enigma of past market data, such as price and volume, to unveil the portents of future price movements. With charts and technical indicators as guiding stars, it seeks to uncover trends and patterns.

The Potency of Compounding

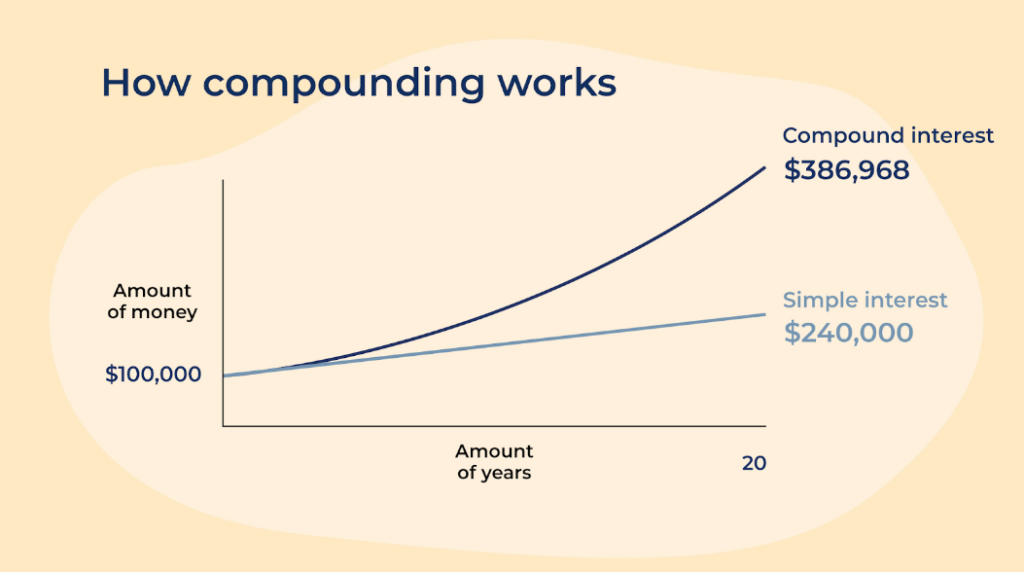

Time in the Market versus Timing the Market A perfect grasp of market timing eludes even the most seasoned investors. Instead, channel your focus towards time in the market. The longer your funds linger in investment, the more they partake in the wondrous alchemy of compounding.

Harvesting the Fruits of Dividend Reinvestment

If your investment venture meanders towards dividend-paying stocks, contemplate reinvesting dividends to procure additional shares. This compounding enchantment can verily fortify your returns over the long haul.

Tax Considerations: The Fiscal Chessboard

The Art of Comprehending Tax Implications Be well-versed in the tax implications of your investments. Assorted account types, like Individual Retirement Accounts (IRAs) and 401(k)s, proffer tax advantages that may fatten your coffers in the long run.

Conclusion

In summation, embarking upon the path of stock investments can be a gratifying expedition, underpinned by knowledge and judicious planning. Remember to plunge into extensive research, delineate crystal-clear investment goals, and weave the threads of diversification into your portfolio. Assess your tolerance for risk and harness the mystical power of compounding to orchestrate a symphony of financial dreams through your investments. By heeding these guiding principles, you shall gallantly navigate the labyrinthine stock market and venture forth to seize the realization of your financial aspirations.

I have been investing now for over 3 years, and as any neophyte in the beginning I’ve made so many mistakes.

I think the best advice I can give is dividend reinvestment. You will loose so much if you don’t reinvest your dividends!

Anyway the article is interesting.

KR

Peter

Thanks for the tips you really provide as part of your blog.