Introduction

Lynch’s net worth is estimated to be $450 million as of 2023 by Celebrity Net Worth. According to Boston Magazine, he was the 33rd richest Boston citizen in 2006, having a net worth of $352 million at the time. He has donated tens of millions of dollars, maybe up to $100 million, to numerous causes.

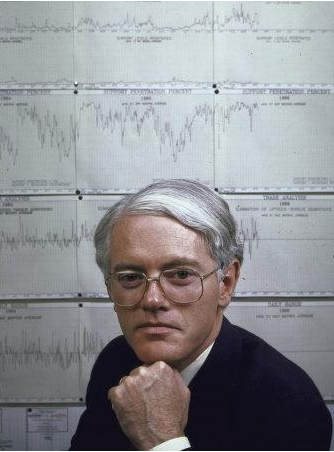

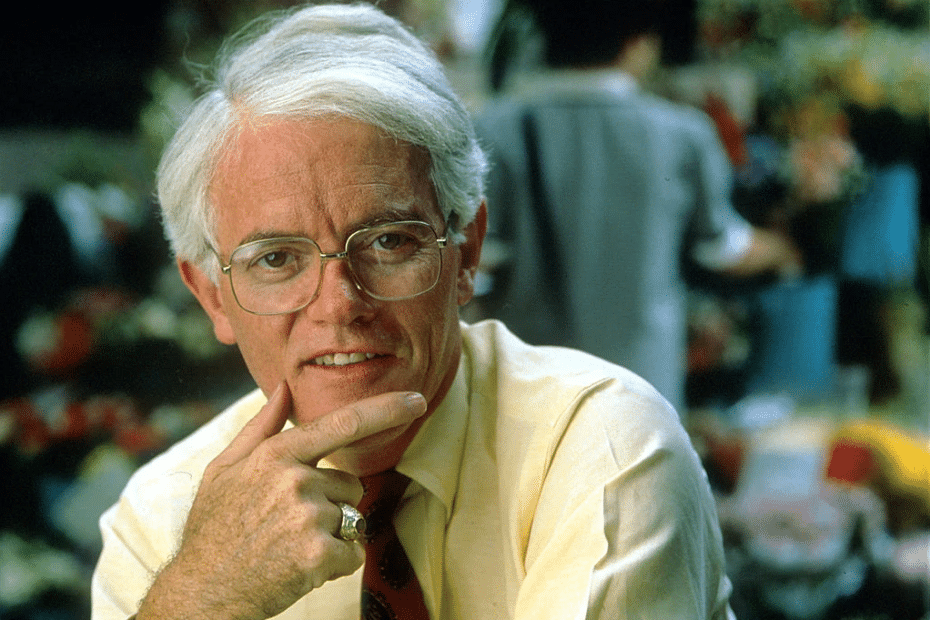

Between 1977 and 1990, Peter managed the Magellan Fund for Fidelity Investments, averaging an astounding 29.2% yearly return. During his leadership, the fund saw historic growth and became the world’s best-performing mutual fund. Under Peter’s leadership, assets under management increased from $18 million to $14 billion. Peter Lynch has co-authored a number of investment books and papers.

1.Early Life and Education

1.1 A Passion for Numbers

Peter Lynch was born on January 19, 1944, in Newton, Massachusetts. From a young age, he displayed a keen interest in numbers and finance. His curiosity about the stock market was sparked by regular discussions at the dinner table, as his father worked as a plumber and often talked about stocks.

1.2 From Boston to Wharton School of Business

Lynch attended Boston College and graduated with a degree in finance. He then pursued a Master’s in Business Administration at the Wharton School of Business at the University of Pennsylvania, where he honed his financial skills and refined his investment acumen. It was a turning point in his life: It was there that he discovered his passion for the stock markets, through conversations with traders!

2.Rise to Prominence

2.1 Joining Fidelity Investments

In 1969, Lynch joined Fidelity Investments as an intern, and within a year, he became a full-fledged research analyst. Lynch’s thorough research methods, coupled with his natural curiosity and dedication, made him a standout analyst at Fidelity. He built a reputation for accurately predicting industry trends and identifying undervalued stocks with significant growth potential. His investment recommendations started to yield exceptional returns, and he quickly gained the trust of Fidelity’s clients and colleagues. He was promoted to the director of research.

2.2 Taking Over the Magellan Fund

In 1977, Lynch was offered an opportunity that would change the course of his career forever. He was named manager of Fidelity’s Magellan Fund. He was given the reins of what was then a struggling fund. His approach paid off handsomely. The Magellan Fund’s performance skyrocketed, and it quickly became one of the best-performing mutual funds in the industry.

3.Lynch’s Investment Philosophy

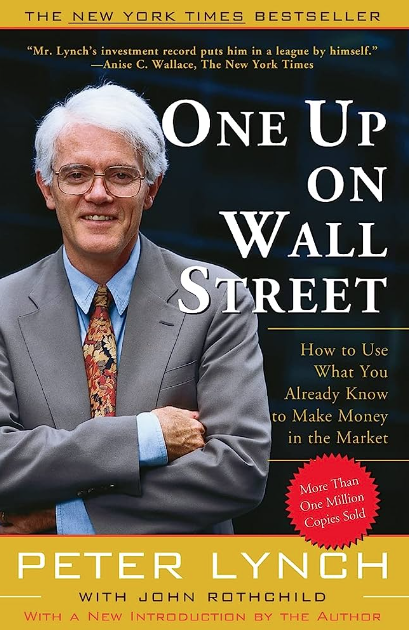

3.1 Invest in What You Know

Peter Lynch’s famous investment mantra, “Buy what you know,” revolutionized the way individual investors approached the stock market. Lynch believed that ordinary people could gain an edge in investing by paying attention to the products and services they encountered in their daily lives. His philosophy encouraged investors to focus on companies whose businesses they understood and products they believed in.

By investing in familiar industries, Lynch believed individuals could identify growth opportunities and spot potential winners before they became widely recognized by Wall Street. This approach allowed Lynch to discover hidden gems and get in on promising companies early, leading to remarkable returns. He often cited examples of successful investments he made simply by observing popular trends or the companies his family and friends were enthusiastic about. Lynch’s “Invest in what you know” strategy remains a valuable lesson for investors, emphasizing the importance of thorough research and personal experience in building a profitable investment portfolio.

3.2 The Power of Long-Term Investing

At a time when short-term trading and market speculation were prevalent, Peter Lynch stood out as a vocal proponent of long-term investing. He believed that investors’ patience and commitment to their investment choices were key to achieving substantial gains. Lynch’s long-term approach allowed him to endure market fluctuations and avoid getting swayed by short-term market noise. He often compared the stock market to a roller coaster ride, where prices would fluctuate in the short term but generally trend upward over the long haul.

By staying invested in solid companies with strong growth prospects, Lynch demonstrated how holding on to winners for extended periods could lead to significant wealth accumulation. He famously stated:

“In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

He emphasis on patience, persistence, and a steadfast focus on the long term has become a timeless lesson for investors seeking to build sustainable wealth.

3.3 Identifying Multibagger Stocks

One of Peter Lynch’s greatest strengths was his ability to identify “multibagger” stocks, referring to those that experience explosive growth and deliver extraordinary returns. Lynch believed that such opportunities could arise from companies with substantial growth potential, often overlooked by the broader market.

He looked for signs of undervaluation and examined the long-term prospects of businesses with a competitive advantage. To uncover these hidden gems, Lynch engaged in thorough fundamental analysis, evaluating financial statements, industry trends, and company management. His investment process involved seeking out companies with strong earnings growth, reasonable valuations, and robust future prospects.

Lynch was not afraid to take contrarian positions, investing in companies that were out of favor with the market but had solid fundamentals. His keen eye for identifying multibaggers led to some of his most significant investment successes, reinforcing the importance of diligent research and a forward-looking perspective in selecting winning stocks. His expertise in spotting these hidden opportunities remains an learning for investors who want to achieve exceptional returns in the stock market.

4.Lessons from Peter Lynch

4.1 Stay Informed and Trust Your Instincts

Peter Lynch believed that staying informed was a fundamental requirement for successful investing. He emphasized the importance of continuous learning and keeping abreast of market trends, economic developments, and changes in the industries one invested in.

Lynch often spent countless hours reading financial reports, attending conferences, and conducting research to make well-informed decisions. Additionally, he encouraged investors to trust their instincts and intuition when making investment choices. While data and analysis were essential, Lynch acknowledged that there were times when a gut feeling or an understanding of consumer behavior could provide valuable insights.

4.2 Patience and Persistence Pay Off

Patience and persistence were hallmarks of Peter Lynch’s investing philosophy. He was a firm believer in giving investments time to mature and achieve their full potential. Lynch cautioned against the temptation of frequently buying and selling stocks based on short-term market fluctuations. Instead, he advised investors to have a long-term perspective and the willingness to endure temporary downturns. Lynch’s own journey to success was marked by both ups and downs, but his patience paid off handsomely in the end.

4.3 Avoiding Emotional Investing

Peter Lynch stressed the importance of avoiding emotional decision-making when it came to investing. He recognized that emotions could cloud judgment and lead to impulsive actions, which could be detrimental to one’s financial goals. Lynch advised investors to make decisions based on research, analysis, and rational thinking rather than being swayed by fear or greed. Emotional investing could result in buying at the peak of market euphoria or selling in a panic during downturns, both of which could lead to significant losses. Lynch recommended setting clear investment objectives and sticking to a well-defined strategy, irrespective of short-term market movements.

5.Peter Lynch’s Legacy

5.1 Continuation of His Principles

Peter Lynch’s investment principles, such as “Buy what you know” and long-term investing, continue to be embraced and practiced by investors worldwide. His emphasis on thorough research and fundamental analysis remains crucial for making informed investment decisions, while his advocacy for patience inspires investors to weather market fluctuations for long-term gains.

5.2 Inspiring Future Generations

Lynch’s journey from intern to legendary investor serves as a powerful inspiration for aspiring investors. His relatable approach and dedication to empowering individual investors have left a lasting impact on the investment industry. Lynch’s legacy continues to shape the minds of those seeking financial success through astute investing, making him an enduring figure in finance.

6. Others facts about Peter Lynch

How much money did Peter Lynch manage?

From 1977 to 1990, Lynch made his name as manager of Fidelity’s Magellan Fund. The fund returned 29.2% a year, consistently more than doubling the S&P 500 during his 13-year tenure. During this time, Magellan’s assets under management grew from US$20 million to US $14 billion.

How old was Peter Lynch when retired?

He suddenly retired at age 46 in 1990 after growing the Magellan Fund.

Pingback: One Up on Wall Street - Key Ideas - 2023 review

Thanks for your write-up.