Betting on the rise or fall of an asset with CFDs. A (risky) product that allows you to bet on the movements of financial assets.

Introduction — What is a CFD ?

A CFD, or Contract for Difference, is an instrument that essentially enables you to speculate in the very short term by betting that an underlying asset will rise or fall in price.

Wait.. what is An underlying asset? 🤔

Behind this jargon lies something very simple: the value of a CFD will depend on the movements of other financial products or indices. For example, there are :

- CFDs whose price depends on changes in the price of a share.

- CFDs whose price depends on the variation of an index.

- CFDs whose price depends on the price of a commodity such as oil or gold.

So a CFD is a derivative product.

Wait again.. what is derivative product? 🤔

This simply means that you are not the owner of the financial product on which the CFD depends. In the case of a CFD backed by a Tesla share, you don’t own the Tesla share, but simply a contract whose underlying asset is the Tesla share.

Although many investors use CFDs for short-term trading, you can theoretically hold an open position (i.e. not sell) indefinitely.

How CFDs work and how to invest?

The theoretical part 🧑🎓

In the world of CFDs, there are buyers and sellers. Let’s imagine that the underlying asset is the MSFT (Microsoft) share, which costs €100 (fictitious price).

The buyer thinks that MSFT is going to announce incredible results. He will therefore bet that the MSFT share price will rise in the short term.

The seller thinks that MSFT will disappoint with this announcement. He will therefore bet that MSFT’s share price will fall.

Both buy a CFD whose reference price is the MSFT share price at time T (here €100).

Result: MSFT announces disappointing sales. The markets open and the MSFT share price falls sharply to €80.

The buyer and seller will gain or lose the difference between the share price when buying the CFD and the share price when selling the CFD.

Both people decide to close (sell) their CFD when the markets open:

- The seller will gain €20 → 100 – 80 = €20.

- The buyer will lose €20 → 80 – 100 = -€20.

Unlike a listed share, the price of a CFD does not depend on supply and demand. It’s a contract between you and a financial intermediary.

To sum up:

- Buy = bet that the price will rise.

- Sell = bet that the price will fall.

The practical part: how to invest in a CFD 💻

Once you’ve got the hang of it, investing in CFDs is as simple as buying a stock:

- You register on an app that lets you buy CFDs.

- Choose a CFD (CFD from a stock, from an index, from a commodity

- You bet up or down.

- You wait.

- You close your position.

- You win or lose money.

As the CFD market is largely unregulated, I advise you to use reputable services. You can use :

💡 Beware, on some platforms we don't talk about buying and selling, but sometimes about "short" and "buy" or "short" and "long" positions. Short means you're betting that the price of the underlying will fall (it comes from "to short" in English). A "long" position means you're betting that the price of the underlying will rise.Leverage effects

I warn you, we’re getting close to the casino! 🎰

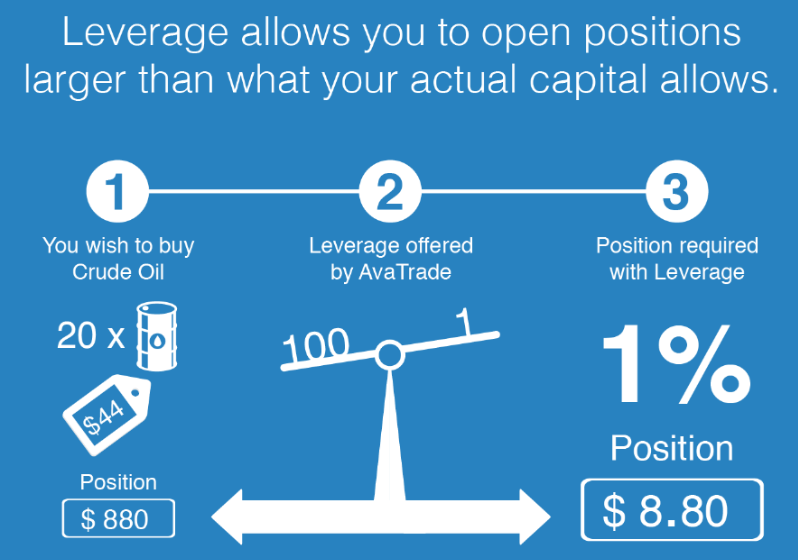

On many platforms, you can apply leverage to your CFDs. In simple terms, these are boosters that can accelerate your gains, but also your losses.

Leverage increases your exposure to price movements for the simple reason that an intermediary like eToro is going to lend you money (which is why in real estate we also talk about leverage when you borrow from a bank to invest in an apartment).

If you invest €100 on eToro on a MSFT CFD with leverage x5, in a buy position (you bet that the share will rise), virtually your position amounts to €500.

If the stock rises by 10%, you won’t gain €10, but €50, and conversely, if it falls by 10%, you won’t lose €10, but €50.

You can win more and lose more, but you can’t go negative on eToro. You can’t lose more than you’ve invested.

Be careful, because on some platforms it’s possible to lose more than your investment, as you also have to repay the loan. During the last market euphoria in 2020, 2021, many young American investors lost huge amounts of money. Some even committed suicide following abysmal losses.

So that brings us to the most important part…

Don’t invest in CFDs if you’re not experienced!

The title may be a little provocative, but it’s the truth. The vast majority of investors lose money investing via CFDs. If you’re not a pro (and I think even most pros lose), stay away from these products.

For example, eToro tells us on its site:

CFDs are complex instruments and present a high risk of losing money quickly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You need to know if you understand how CFDs work and if you can afford to lose your money.

In fact, the mechanism is extremely addictive and very casino-like for several reasons:

- Thanks to the leverage effect, variations can be violent and create the same rush you might have when playing roulette.

- If you win the first time, your confidence level will rise and you’ll take more and more risks. I once tried to invest €1,000 in a CFD and doubled my stake within a few hours. A few days later, I tried again with a larger sum and lost almost everything.

- The worst thing is that a few months later I tried again, even though I know it’s completely stupid.

There are many risks to investing in CFDs, and here are the main ones:

- Leverage can make you win a lot, just as it can make you lose a lot.

- It’s extremely difficult to predict the movements of financial assets over a short period of time. In the space of a day, a stock can fall sharply or rise sharply for any number of reasons, and you can very quickly lose your entire investment.

- The CFD market is not well regulated, and you can sometimes come across scams. If you’re approached to invest in CFDs, be very careful and don’t follow up on these solicitations, as you could come across scams. Check that the website offering CFDs is authorized in your country. To do this, consult the local regulation authority (for instance, it’s the SEC in USA).

- Don’t overlook the addictive side of these instruments.

So what are CFDs good for?

CFDs can be interesting for creating complex investment strategies that can make you money even when markets are falling.

They can also be useful for protecting you against currency fluctuations. For example, if you’ve invested heavily in dollar-denominated equities, you could invest in a CFD that will increase in value if the dollar falls. On the one hand, you’ll lose money, but on the other, you’ll make money. That’s what we call hedging.

But for the vast majority of private investors, it’s just a product that allows intermediaries to make a lot of money!

Conclusion

I hope you now have a better understanding of how CFDs work, and how dangerous they can be.

Only get involved with these instruments if you are aware of the risks involved and are relatively experienced.

As always, in the vast majority of cases, invest for the long term. Indeed, trying to predict short-term market movements is a bit like tilting at windmills…